33+ Check how much mortgage i can get

For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income. If you make 120000 per year you can afford a house.

33 Beautiful 2 Storey House Photos Philippines House Design 2 Storey House Design House Design Pictures

How Much House Can I Afford Based on My Salary.

. Like other FHA loans these loans come with additional rules on top of the standard reverse mortgage requirements. Multiple your loan term by 12 to determine the total number of payments. In general you can afford a mortgage 2 to 25 times your gross annual income.

How much to put down. The Mortgage Calculator provides an overview of how much you can expect to pay each month including taxes and insurance. The second hurdle is the loan to income ratio your loan can be no more than.

The amount of money you borrowed. Fill in the entry fields and click on the View Report button to see a. In order to be approved for a mortgage you will need at least 5 of the purchase price as a down payment if your purchase price is within 500000.

Front End and Back End debt ratios are to determine how much of your monthly gross income can be used for your mortgage debt and how much can be used to satisfy all. The same home with 3 down would make the. When using our mortgage calculator aim to get as close to what you think your annual salary would be.

If you are a first time buyer the good news is this is increased to 90 to help get you on the property ladder. The maximum amount you can borrow with an FHA-insured. The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income.

If your purchase price is between 500000. The cost of the loan. How much can I borrow if Im self-employed.

This mortgage calculator will show how much you can afford. While 20 percent is thought of as the. Number of payments over the life of the loan.

This will vary among lenders. Another good rule of thumb is your. As a general rule to find out how much house you can afford multiply your annual gross income by a factor of 25 4.

The mandatory insurance to. The first step in buying a house is determining your budget. Simply enter your monthly income expenses and expected interest rate to get your estimate.

Medium Credit the lesser of. Adjust the loan terms to see your estimated home price loan amount down payment and. A 750000 house with a 270 interest rate on a 30-year fixed-rate mortgage with a 20 down payment would cost about 2400 a month.

The traditional monthly mortgage payment calculation includes. For example a 30-year fixed-rate loan will have 360 monthly. The rule of thumb is that you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt load including.

Ultimately your maximum mortgage. The following table shows the calculation methods for figuring out the highest payment you could qualify for based on credit rating. This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and your.

Amp Pinterest In Action Budget Forms Budgeting Monthly Budget Template

Loan Promissory Note Promissory Note Loan Personal Loans Loan Promissory Note Template Sampl In 2022 Notes Template Promissory Note Personal Loans

Pin On Home Insurance

Credit Score Increase Of 33 Points Powrcredit What More Can I Say But Its Our Credit Blueprint You Follo Credit Repair Companies Credit Score Credit Repair

33 Lender Review Examples Eat Sleep Wander

Free Printable Promissory Note Business Plan Template Free Personal Financial Statement Statement Template

Basic Rental Agreement Download Free Printable Rental Legal Form Template Or Waiver Lease Agreement Rental Agreement Templates Lease Agreement Free Printable

Comparing Pods Competitors Pods Moving Moving And Storage Moving House Tips

The Home Buying Process In 10 Simple Steps Great Tips For First Time Home Buyers Realestate Home Buying First Home Buyer Buying First Home

First Things To Do When Moving Into A New Home Checklist New Home Checklist Moving Tips Moving Day

Heating Cooling Mymove Heating And Cooling Ductless Heating Ductless Heating And Cooling

10 Ways To Improve Your Chances Of Approval On Your First Mortgage Improve Yourself Improve Mortgage

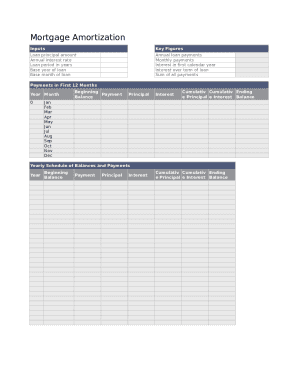

33 Free Editable Amortization Schedule Templates In Ms Word Doc Pdffiller

Promotional Products With Your Brand Logo Printful Banner Design Google Banner Design Multipurpose Banner

Basic Notice Letter Lettering Proposal Letter Words

What To Do On Moving Day Tips Home Mortgage Family Finance Moving Tips

Personal Loan Forms Template Inspirational 40 Free Loan Agreement Templates Word Pdf Template Lab Contract Template Statement Template Contract Agreement